A recap of seven Q1 trends in preparation for Q2 earnings

In March, the spread of the Coronavirus and the resulting public sector response brought an almost overnight change to the daily operations of many enterprises. Our team at NEA looked to quantify its impact with supporting data. In May, we dug through the earnings reports of 60 scaled consumer and enterprise companies across a variety of verticals. Through understanding the performance and outlook of technology, financial services, healthcare, transportation/logistics, travel, retail, industrial, and select other businesses, we looked to stitch together a picture of the initial corporate response to the virus. Here, we share seven key trends that emerged from this work, alongside several interesting statistics from individual companies.

As we prepare for the Q2 ‘20 earnings season, we are curious to understand how the corporate response has shifted with an additional three months of knowledge and data on the novel virus and its impacts on our health and behavior. It will be quite interesting to see how the magnitude of these statistics has changed, which trends continue to be relevant, and which new trends have emerged. These movements will continue to inform our investing theses for the rest of 2020 and beyond; it will be important to draw inferences from these data points to conceptualize their lasting impact on our economy.

At the end of Q1, the main corporate priority was preserving the health and well-being of existing employees and ensuring business continuity. Enabling existing employees to work remotely was a multi-stage process, with many companies temporarily maintaining hybrid work forces to ease the transition. Still, the sentiment towards recovery was quite positive. Retailers, many of whom had already started to see a rebound, anticipated recovery by the end of summer. Harder-hit businesses in industries including travel and hospitality had a bleaker outlook, predicting it would take as long as five years for a return to pre-pandemic levels.

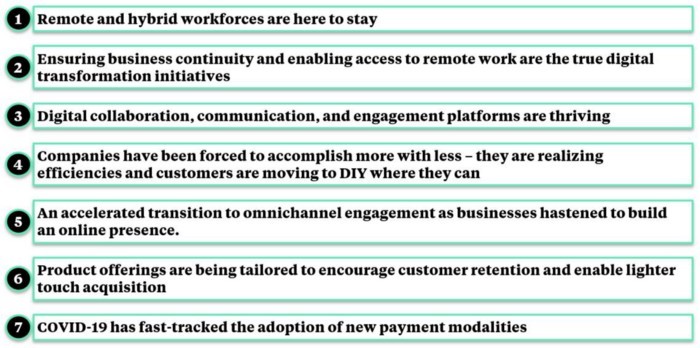

As we continued to dig through the transcripts, the following key themes emerged:

1.

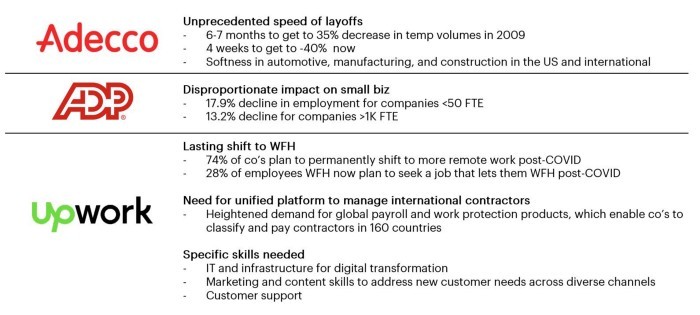

Remote and hybrid workforces are here to stay. An April 2020 Gartner study revealed that 74% of CFOs plan to shift a portion of on-site employees to permanently remote. Employees are warming up to the idea: UpWork found that 28% of employees currently working from home plan to seek a job that allows for remote work post-COVID-19.

In the near-term, as companies are fully distributed due to COVID-19, standing up remote call centers was an immediate priority — albeit one that proved challenging. While companies chased down call center staff, they were also searching for IT talent to assist with digital transformation and for marketing and content-related talent to help reposition and sell product in a new environment.

Below, we share a few stats from Adecco, ADP, and UpWork that discuss immediate changes in personnel due to COVID-19.

Expanding on this, anecdotes from Expedia, SiriusXM, and Zendesk stress the difficulties experienced in staffing call centers to deal with the influx in support requests received and the importance of building strong self-serve capabilities. With all the attention directed here, in May Twilio announced their belief that 50% of contact center seats will be in the cloud by 2025, up from ~17% prior to the pandemic.

2.

Ensuring business continuity and enabling access to remote work were the true digital transformation initiatives. Enterprises raced to lay down some of the fundamental building blocks for cloud and remote; we’re still in the very early innings for any advancement beyond this. Focus on tech was more about cutting tech bloat than adopting brand new solutions outside of what was necessary. Some strategic digital projects were put on the back-burner as these companies adapted to remote work.

We saw three sub-trends here:

- An accelerated shift of workloads to the cloud

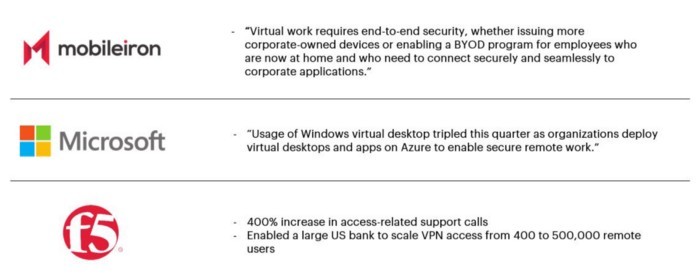

- The importance of secure remote access

- Device proliferation with bring-your-own-device (BYOD)

On the first, cloud spend continued to increase meaningfully year-on-year. Azure revenue was up 59%, GCP was up 52%, and AWS was up 33%. A Q4 Goldman Sachs CIO survey showed an expected uptick in 3-years-out cloud workload adoption to 43%, up from 36% prior (we’re at 23% today). We expect this to have accelerated further since.

Second, secure remote access is increasingly important. In the first quarter, F5 helped a single financial institution scale VPN access from 400 to 500K remote users, usage of Windows virtual desktop grew 3x QoQ, and Citrix added $47M in subscription in the quarter for short-term burst VDI capacity. Citrix’s overall subscription ARR, $840M, was up 50% YoY in the quarter. The company believes its only 30% penetrated within its existing customers. Our portfolio company Splashtop has had a front row seat here as enterprises race to ramp their subscriptions.

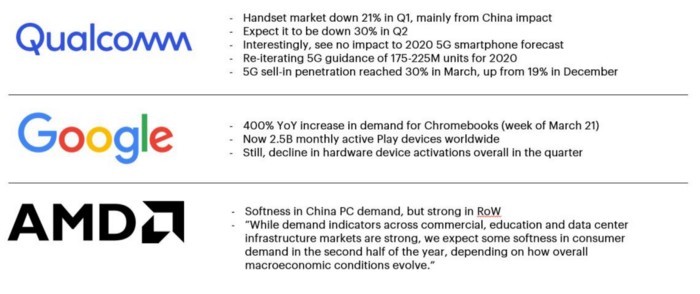

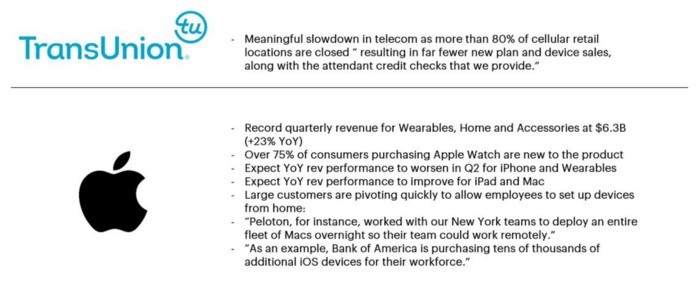

BYOD continues to grow in prominence, though hardware sales in Q1 were mixed. There was softness in handset sales outside of 5G devices, which saw no impact. Other trends varied drastically by manufacturer. Google saw strong demand for Chromebooks while Apple saw strong growth in wearables. Apple forecast a shift in behavior for Q2 and expects iPhone and wearable purchasing to decline while iPad and Mac revenue performance will increase. AMD expects consumer demand to have declined in Q2 while the commercial markets remained strong. AMD and Apple will report their updates on July 29th and 30th, respectively.

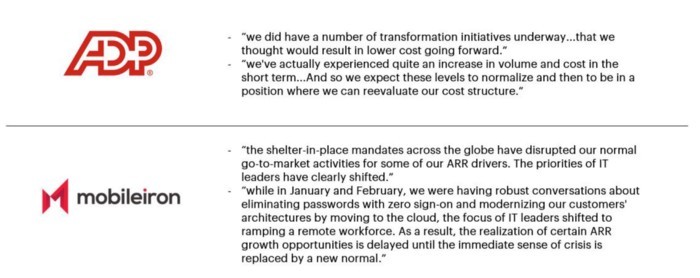

For several companies, adjusting to COVID meant shelving ongoing digital transformation projects. For example: ADP sidelined technology initiatives geared at reducing cost while the company had to direct focus on increasing support capacity; MobileIron’s statement on impacted GTM shows us that corporate IT departments again prioritized standing up remote work over adding new technical capabilities like zero sign-on.

3.

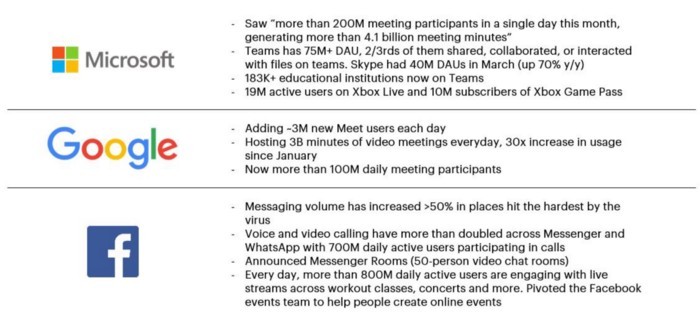

Digital collaboration, communication, and engagement platforms are thriving. While video connectivity and collaboration and messaging were in an early adoption phase only a few years ago, the rapid change to working from home has pushed these technologies further into the mainstream, driving faster adoption.

These tools are seeing traction in both consumer and enterprise applications. A few select stats are highlighted here, with additional detail in the graphics below.

- Microsoft saw more than 200M meeting participants in a single day

- Google saw 100M+ meeting participants/day. Meet is adding 3M+ users/day

- Facebook is seeing 700M DAUs across WhatsApp and Messenger

- Peloton saw 94% YoY growth in connected fitness subscribers, up to 886K (now past 1M)

- Live Nation has seen >1M fans on “Live at Home” virtual performance sites

Importantly, this traction has led to a proliferation of communications platforms — we’ve seen quite a lot of investment and M&A activity in companies including BlueJeans, Hopin, Run the World, Bevy, and others. With a competitive landscape that is only getting more diverse, we’ll be watching to see how the larger tech companies (MSFT, GOOG) leverage their productivity suites for scale and try to out-compete these best-in-breed offerings.

4.

Companies have been forced to accomplish more with less. With constraints on resources due to tightened budgets and/or reductions in force, both enterprises and consumers are moving to DIY where they can.

- With headcount reductions already completed, firms are seeing continued growth and progress with leaner teams. The global transportation and logistics firm CH Robinson noted “we’re doing more with less in the field.” The company saw “strong volume growth with 7% fewer employees.”

- Low-Code/No-Code platforms are seeing interest as companies look to quickly build in-house solutions. ServiceNow’s Now Platform was used by Lowe’s to build an emergency paid leave app that was deployed to 330K employees within four days. MSFT Power Platform is now used by 3.4M ‘citizen developers.’

- Consumers are also looking to save on services spend and defray costs. Tax filings are one example. While total Q1 e-file tax returns were down 9.6%, self-prepared files were up 2.2% and assisted files were down 18.8%.

5.

An accelerated transition to omnichannel engagement as businesses hastened to build an online presence.

With most in-person channels shut down for the time being, companies are being forced to find new modes of attracting customers. Retailers have had to explore online channels as brick-and-mortar sales were impacted by shelter-in-place orders. With this evolution, enterprises have brought more focus to capabilities that allow them to simultaneously expand and unify their reach.

In Q1, we saw businesses onboard to platforms that provide an integrated and unified experience across customer touch points more rapidly than ever before. For example:

- Shopify saw 62% growth in new store creations (3/13–4/24) vs 6 weeks prior; the platform saw 85% growth in stores created in 3 days or less vs 6 weeks prior

- Square’s online store saw 5x GPV growth between mid-March and May; 2/3rds of their GPV came from their new pickup and delivery service

- Intuit is now looking to create a central platform that helps customers manage capital and get insights across channels

6.

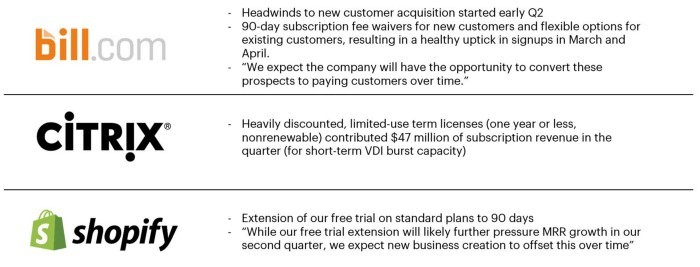

Product offerings are being tailored to encourage customer retention and enable lighter touch acquisition.

As customers are cash and resource strapped, they are evaluating spend across technology vendors. To avoid being cut, enterprises are encouraging downgrades over outright churn. Sales reps are now enabled to offer limited term discounts and downgrades. Customers are also being granted more flexible payment terms and longer payback windows.

To bring in new customers, many enterprises are interestingly driving product innovation at the low end of their product suite and complementing this tier with generous free trials. As an example, HubSpot reduced the price of their starter suite by 50%, resulting in a 5x increase in run-rate revenue for the product. Dropbox saw a 40% increase in business teams trials.

While these strategies together will help customers downgrade and retain, they are likely leading to large stables of currently low-value customers who will need to be converted and upsold over time. We’re curious to understand what conversion and retention metrics will be presented in the Q2 readouts.

A few more examples from eCommerce companies, where this trend was especially pronounced:

- Shopify extended free trials on their standard plans to 90 days

- Square refunded all March software subscription fees for sellers

- Mercado Libre eliminated commissions on 1K SKUs, reduced listing fees for new sellers, and eliminated late fees for 150K merchants

Last, companies with naturally longer sales cycles are seeing headwinds to new customer acquisition. Many are experimenting with new outbound methods and hosting virtual trade shows, conferences, and webinars. Appian, NewRelic, and Datadog specifically called this out during their earnings calls.

Again, a selection of anecdotes are shared in the graphics below:

7.

COVID-19 has fast-tracked the adoption of new payment modalities, and we’re excited about potentially lasting changes to consumer and business payment behavior.

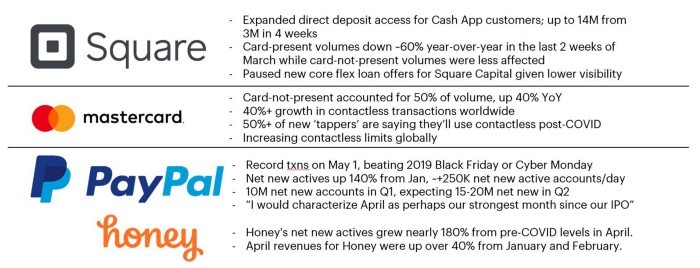

Contactless transactions are here to stay. A Mastercard survey found that 50% of new ‘tappers’ will continue to use contactless payments post-COVID. The company saw a 40% growth in contactless transactions worldwide. Simultaneously, Square saw card present volumes decline 60% YoY. In addition to contactless payments, consumers are open to experimenting with new methods to pay, including QR codes.

The increase in online purchasing is also helping boost card-not-present volumes. Mastercard saw card-not-present volumes grow 40% YoY. Elsewhere in online payment trends, PayPal saw 10M net new accounts in Q1, and a volume of transactions on May 1 that beat Black Friday or Cyber Monday. Honey, which was recently acquired by PayPal, saw 180% growth in net new actives in April vs pre-COVID.

Beyond payments, we’re also interested to track the changes in remittance and lending volumes.

Remittance is an arena where the jury is still out. Xoom saw a 400% increase in service usage between February and May and we can make an argument that remittance volumes are moving to digital as consumers are looking for new ways to send money back home. Still, the World Bank expects global volumes to drop by 20%, driven by the fall in wages and employment of migrant workers due to COVID-19.

Finally, new lending has been mixed on a product-by-product basis. More interesting is the impact to collections — lenders are having trouble collecting on outstanding balances as collectors are ill-equipped to work from home. As a historically very high-touch industry, we’re curious to see if COVID-19 allows for any breakthroughs in digital collections.

In summary, Q1 earnings reflected the state of business following an average of one month’s exposure to the virus. While some sizable shifts in consumer and enterprise behavior were underway, business continuity planning was the most top of mind. Corporations’ #1 priority was getting employees situated to work from home and ensuring both the health of the workforce and of the company’s core product. In terms of new technology adoption, companies were laying down some of the fundamental building blocks for cloud and remote, and focused on cutting tech bloat rather than adopting new solutions. Where tools were needed, DIY and no-code/low-code stood out as strong options. Additionally, given the adoption speed necessary, some customers indicated a preference for full platform solutions vs. best in breed tools, whether in omnichannel commerce or collaboration and productivity. Across the board, companies are prioritizing retention via access to discounts and downgrades while investing in and driving new traffic to entry-level tier products. They are seeing strong adoption here but will have significant work to do in Q2 and beyond in upselling these clients.

These initial trends point to several interesting investing opportunities. We’re looking forward to learning more about the latest innovations in contact center platforms, omnichannel engagement suites, pricing and discounting tools, customer success software and more.

We’re eager to see which trends have continued and which forecasts come true as corporations report out this week and onward. We’re curious to understand which businesses have been able to successfully transition to work from home, and which have struggled to make the leap. If we believe remote is the future, are there technologies we can invest in to help modernize those industries that are lagging behind? Similarly, in areas where enterprises have realized clear efficiencies from remote work, are there products we can create to unlock this benefit for others?

We’ll plan to repeat this exercise at the culmination of the Q2 earnings season and are excited to draw a comparison to some of these initial trends. Stay tuned for the results!

Follow us on Twitter for more updates on earnings and tech trends: @jaisajnani, @psonsini, @vanessaxdeng; Learn more about us at https://www.nea.com/, @NEA

Statistics referenced in this document were obtained from each respective company’s Q1 earnings presentation and transcript.